A Growing Priority For B2B

Many organizations adopting demand optimization strategies

By Andrew Gaffney, Editor

If you have noticed a clog in your sales pipeline over the past few years, you are not alone. Identifying qualified buyers has become increasingly difficult for most companies, particularly in technology and other big ticket B2B and B2C sectors, and the problem has been compounded by the fact that deals are taking longer to close.

SiriusDecisions, a Wilton, CT-based research firm focused on sales & marketing benchmarks, has been collecting data from more than 300 B2B marketers, and has found a consistent challenge with demand generation efforts. “We look at everything including spend, budgets, response rates, conversion rates and overall performance,” says John Neeson, Managing Director and Co-Founder of SiriusDecisions.

__________________________________________________________________

According to research from SiriusDecisions, the average selling cycle for deals $100,000 and over is 22% longer on average than it was five years, and there are 3.5 more people involved in the decision-making process.

__________________________________________________________________

According to research from SiriusDecisions, the average selling cycle for deals $100,000 and over is 22% longer on average than it was five years, and there are 3.5 more people involved in the decision-making process. Based on this increased complexity, marketers are pushing to have more prospects in the pipeline. For example, the traditional metric for many marketers had been to have a ratio of 3 to 1 of prospects to sales quota. However, as the go-to-market model has begun to shift, Neeson says that average has been pushed up to 3.6 to 1.

One clear trend among the companies SiriusDecisions measures is a growing emphasis on feeding and managing the pipeline. “Demand generation is the only category where spending has consistently increased over the past five years. It now accounts for between 40% to 60% of most B2B marketing budgets,” he says. “And companies are clearly relying more on marketing to drive demand generation.”

PIPELINE STAGES

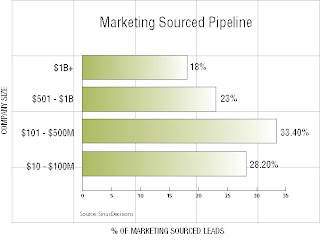

The focus on lead and demand generation has been heating up steadily for the past five years, but the level of sophistication being applied to the issue has varied widely among different companies. Surprisingly, Neeson says he often finds small to mid-sized companies are often more advanced at managing the process than some of the larger, global organizations.

One common approach among B2B companies has been segmenting their marketing efforts to target prospective customers at different phases of the buying cycle. For example, some leading marketers have developed specific campaigns and follow-up business processes for different target audiences into the following segments:

· Awareness

· Consideration

· Preference

· Close

Each audience segment has its own creative and messaging attached to it, as well as sales collateral and follow-up process.

In addition to segmented marketing, the majority of B2B companies have developed a system for rating the sales leads in its pipelines. The oldest and most elementary method is the A, B, C, D method of prioritizing prospects, although many sales and marketing executives that employ this technique admit there are often no formal guidelines for how an A lead is handled versus a prospect rated a D.

As one VP with a large software supplier described their current system. “We just got back from a major trade show with what I would consider 27 urgent sales leads, but even I’m not clear on what metrics we are using to narrow down and prioritize which of those should have the most urgency and attention.”

LEAD ARCHITECTURES

Over the past two years, the process has been getting more structured and Neeson says many companies have evolved to what Sirius describes as a “lead architecture,” which often employs formal lead scoring systems, as well as lead nurturing and management systems.

One of the leading solution providers offering these types of products is Eloqua, headquartered in Toronto. Thor Johnson, Eloqua’s SVP Marketing, says the company’s marketing automation solutions have taken the mystery out of demand generation for more than 250 different customers.

“The problem with the pipeline is at the front of the funnel for most companies. Lead generation is a unique process in that it spans 2 very different departments, which can wind up at odds if the process isn’t optimized,” Johnson explains. “For the companies that have aligned their sales and marketing efforts, and have a common definition of what a lead is and where that lead is in the buying process, they usually see a significant improvement in the number of leads closed.”

Eloqua’s customer base runs the gamut of large, publicly-traded companies such as Sybase to smaller venture-backed firms in technology, financial services and business services. “Our clients are automating the process from initial lead generation all the way to revenue generation and are able to attach predictive models to the process. For example, our more advanced clients are able to know that for every $1 they put into demand generation they are going to get $5, $10 or $15 dollars out depending on their sophistication.”

One of the consistent findings from the research and customer feedback gathered by both Eloqua and Sirius is that the effectiveness of different marketing tools varies based on the stage of the lead. For example, Sirius data shows that tools such as white papers and web seminars have been more effective with early to mid-stage leads, while offers such as ROI calculations and free trial downloads have been more effective with late stage prospects.

THE NEW DEMAND MODEL

As Eloqua’s Johnson points out, improving the pipeline for many organizations typically involves better aligning their sales and marketing efforts. Analysts agree that the role for both lines of business has clearly changed in recent years.

Alan Rigg, President of 80/20 Sales Performance, a consulting firm with clients in technology, healthcare and financial services, says a consistent problem across industries is that “there aren’t enough opportunities in the pipeline.” Rigg attributes that trend primarily to the fact that most salespeople either don’t have the time or the training to prospect effectively.

Rigg says that some of the best salespeople he encounters are typically too bogged down with administrative process and procedures to make time to breakthrough with new prospects. “A lot of the top salespeople I meet have a low tolerance for administrative activity and a limited ability to do it well,” he says, pointing to the intricate CRM and sales tracking systems that many companies have implemented in recent years.

Benchmark data from SiriusDecisions supports that opinion, with recent research showing B2B salespeople spend only 18% of their time face-to-face with prospects, while 10% is consumed with admin duties and 18% conducting research.

Rigg points out that many of his clients are supplementing the efforts of their salespeople with more inside or pre-sales staff, as well as increased administrative support in order to free the sales team up to be in front of key clients and prospects. “Most good salespeople tend to be pretty expensive so you don’t want them filling out paperwork and dialing for dollars. It only makes sense to push these tasks to a lower cost resource. The ideal scenario is for your salespeople to focus their time and energy on qualifying opportunities and moving them through the sales cycle at maximum speed.”

The realization that the sales pipeline needs more support has resulted in many companies building a specific team, under the header of field marketing or demand generation to drive and manage sales leads. “The marketing organization of the future will look very different,” says SiriusDecisions’ Neeson. “The CEO will have very distinct dials he or she can go to—including awareness and demand generation—and get an accurate read of how the company is performing in each area.”

No comments:

Post a Comment